Owning a home is a big step, but it comes with responsibilities, like protecting it with the right insurance. Home insurance shields your property from unexpected events that could damage or destroy it. Here’s what you need to know:

Why Home Insurance Matters:

Your home is likely one of your most valuable assets, so protecting it is crucial.

Home insurance covers property damage, liability, personal belongings, and additional living expenses.

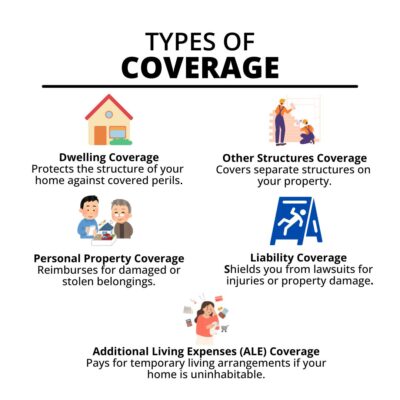

Types of Coverage:

Dwelling Coverage

Protects the structure of your home against covered perils.

Other Structures Coverage

Covers separate structures on your property.

Personal Property Coverage

Reimburses for damaged or stolen belongings.

Liability Coverage

Shields you from lawsuits for injuries or property damage.

Additional Living Expenses (ALE) Coverage

Pays for temporary living arrangements if your home is uninhabitable.

Factors Affecting Premiums:

Location, property value, deductible, home features, and claim history all influence your insurance costs.

Conclusion:

Home insurance is vital for protecting your home and belongings. Understanding its basics helps you make informed decisions and ensures your peace of mind. Regularly reviewing your policy keeps you prepared for any unforeseen events. With the right coverage, you can rest easy knowing your home is safe and secure.

Searching for your next property investment? Explore our listings – your ideal opportunity might just be waiting for you! Click here.

Attention first-time home buyers! Dive into these invaluable tips for a seamless and stress-free house purchase journey. Let’s make your dream home a reality! Click here.